CVS Stock Dividend 2025:

CVS Health Corporation (NYSE: CVS) has recently announced a quarterly cash dividend of $0.665 per share, reaffirming its commitment to delivering value to its shareholders. This dividend is set to be paid on August 1, 2025, to those who are shareholders as of July 22, 2025.

In a time when many healthcare companies are reassessing their financial strategies, CVS is standing firm. This reliable dividend showcases the company’s confidence in its cash flow, even as it navigates ongoing changes in its retail and healthcare sectors.

Dividend Yield and Payout Details

For long-term investors, CVS’s dividend is one of the most reliable in the healthcare industry. Here’s a brief overview:

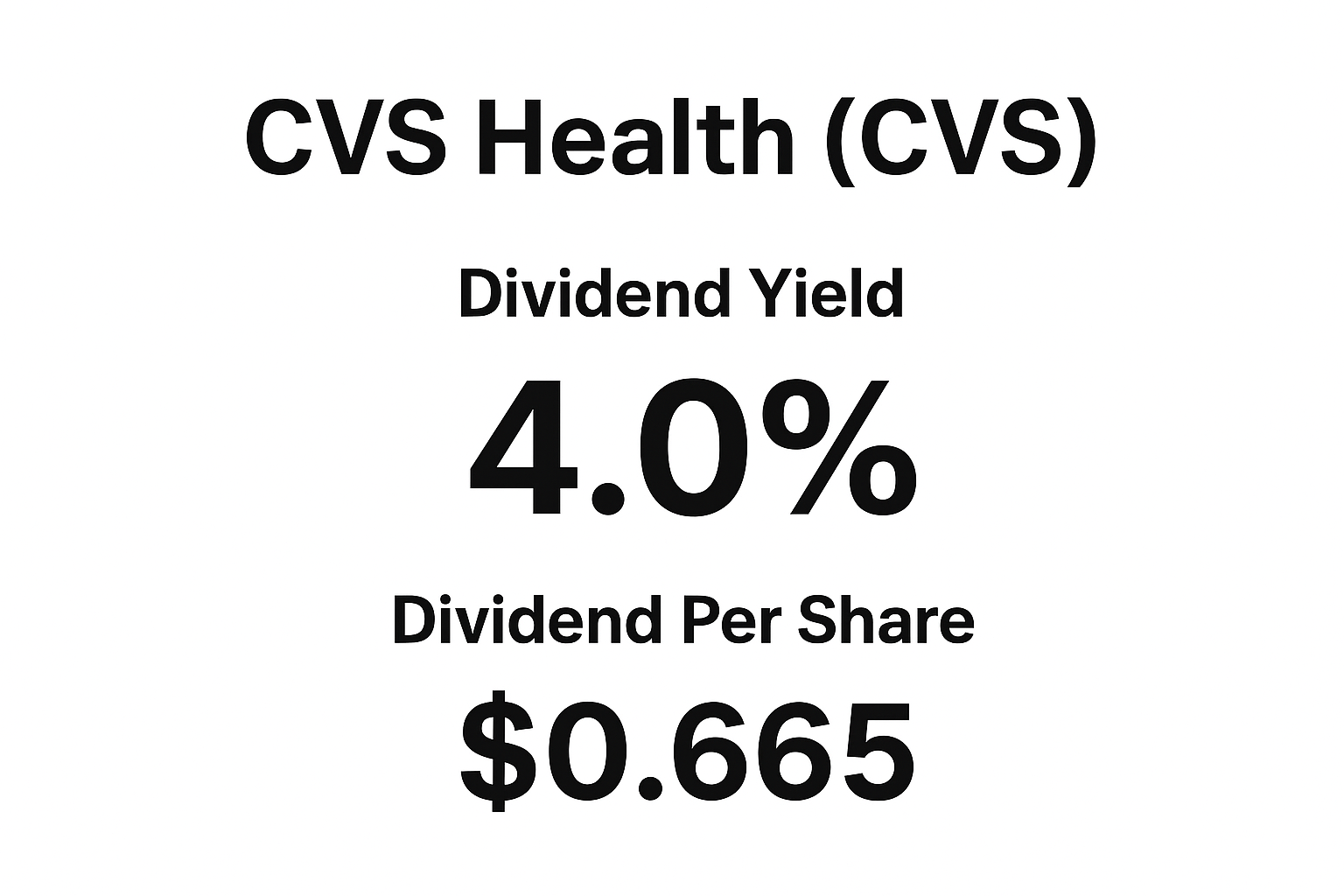

Quarterly dividend: $0.665 per share

Annualized dividend: $2.66 per share

Dividend yield: Approximately 4.0%, based on current stock prices around $83–$84

Payout ratio: About 60–65% of earnings

That 4% yield offers a solid return in today’s market, particularly for those seeking steady income from a stable sector like healthcare.

A Symbol of Stability

Despite encountering various operational hurdles — from pharmacy pricing pressures to restructuring its healthcare services — CVS has successfully maintained a consistent dividend history. This decision indicates to investors that the company remains financially robust.

In fact, CVS has a track record of gradually increasing its dividend payouts. A few years back, the annual dividend was around $2.00 per share. Today, it has risen to about $2.66, which is a positive sign for shareholders focused on income.

Why the CVS Dividend Matters

- Reliable income source:

For those who invest in dividends, CVS stands out as a stable and predictable option. The company consistently delivers quarterly payouts, supported by a well-diversified business model. - Investor confidence:

By maintaining the dividend during strategic reviews, CVS’s management demonstrates their confidence in the company’s financial health. - Balanced risk and reward:

CVS strikes a balance — it’s not a high-risk, high-yield investment, but rather a reliable choice for investors looking for steady returns, especially in uncertain times.

What’s Happening Behind the Scenes

CVS is currently undergoing a strategic transformation, shifting its focus more towards healthcare services and away from traditional retail pharmacy operations. Recent leadership changes and board restructuring suggest that the company is gearing up for a more streamlined and efficient future.

Although this shift may introduce some short-term uncertainty, the decision to maintain the dividend clearly signals that CVS aims to keep its shareholders engaged while it redefines its long-term strategy.

Key Dates for CVS Investors

Record date: July 22, 2025

Payment date: August 1, 2025

Ex-dividend date: July 22, 2025 (investors need to own shares before this date to qualify for the payout)

If you’re thinking about adding CVS to your dividend portfolio, be sure to note these important dates — timing is crucial for receiving your quarterly payout.

How CVS Stacks Up Against Peers

When compared to other major healthcare companies, CVS’s dividend yield remains competitive:

Company Dividend Yield Payout Ratio Dividend Growth Trend

When it comes to dividend investing in the healthcare sector, CVS Health stands in a balanced position — offering a steady yield without taking on excessive payout risk. Let’s see how it compares with other major players in the industry:

| Company | Dividend Yield | Payout Ratio | Dividend Growth Trend | Overall Stability |

|---|---|---|---|---|

| CVS Health (CVS) | ~4.0% | ~63% | Gradual growth | Strong and consistent |

| Walgreens Boots Alliance (WBA) | ~6.5% | Over 100% | Flat to declining | Under financial pressure |

| UnitedHealth Group (UNH) | ~1.4% | Moderate (~30%) | Rapid growth | Very stable earnings |

| Cigna Group (CI) | ~1.7% | ~25% | Steady increases | Solid performance |

While Walgreens may offer a higher yield, CVS appears to be in a stronger financial position, making its dividend more sustainable in the long run.

Should You Consider Investing in CVS for Its Dividend?

If you’re an investor looking for reliable income with some growth potential, CVS could be a great choice. The dividend yield is appealing, the payouts are manageable, and the company is adapting its business model to focus more on higher-margin healthcare services.

That said, if your main goal is to find stocks with rapidly increasing dividends, there are other healthcare companies that might provide quicker payout growth. CVS tends to prioritize consistency and stability over aggressive dividend increases.

Risks to Consider

Healthcare cost challenges: Increasing medical claims and regulatory issues can put pressure on profit margins.

Business changes: The company’s transition towards insurance and care delivery comes with short-term execution risks.

Stock performance: The dividend yield is influenced by the stock price. If the share price rises significantly, the yield may decrease even if the dividend payout remains unchanged.

Nonetheless, CVS’s diverse revenue streams and solid financial position help mitigate these risks.

Final Thoughts

CVS Health’s reliable dividend is a testament to its financial strength and the confidence of its management. With a yield of around 4%, it provides a stable return backed by consistent earnings — making it a trustworthy option for long-term investors focused on income.

As the company continues to evolve its healthcare strategy, holding or adding to your CVS stock could yield both steady income and potential growth in the future.

In the realm of healthcare investing, CVS Health’s dividend serves as a quiet yet powerful indicator of resilience.

🔗 Useful External Links for Further Reading

- CVS Health Official Dividend History – Explore the official CVS Health investor page to view complete dividend history, payout dates, and financial updates.

- Reuters: Activist Investor Glenview Cuts Stake in CVS – Read the latest Reuters coverage on shareholder activity and strategic developments at CVS Health.

- Wall Street Journal: CVS Board Conducts Strategic Review – WSJ reports on CVS’s board review and its impact on long-term company direction.

- MacroTrends: CVS Dividend Yield History – Check historical dividend yield charts for CVS Health, including payout growth trends.

https://bartatime.com/red-cat-stock-surges-after-gps-denied-drone-flight/

1 thought on “CVS Stock Dividend 2025: A Steady Payout in Times of Change”