Netflix Stock Split :

In an unexpected yet thrilling development, Netflix (NASDAQ: NFLX) has declared a 10-for-1 stock split, creating a buzz of optimism on Wall Street. The company announced that for every share currently held, shareholders will receive nine additional shares — a strategy aimed at making Netflix’s stock more accessible to both employees and retail investors.

This decision comes at a time when Netflix’s shares have been trading above $1,000 each, positioning it as one of the most expensive entertainment stocks available. Following the announcement, the stock surged approximately 3% in after-hours trading, reflecting the positive sentiment among investors regarding this move.

💡 What Is a 10-for-1 Stock Split?

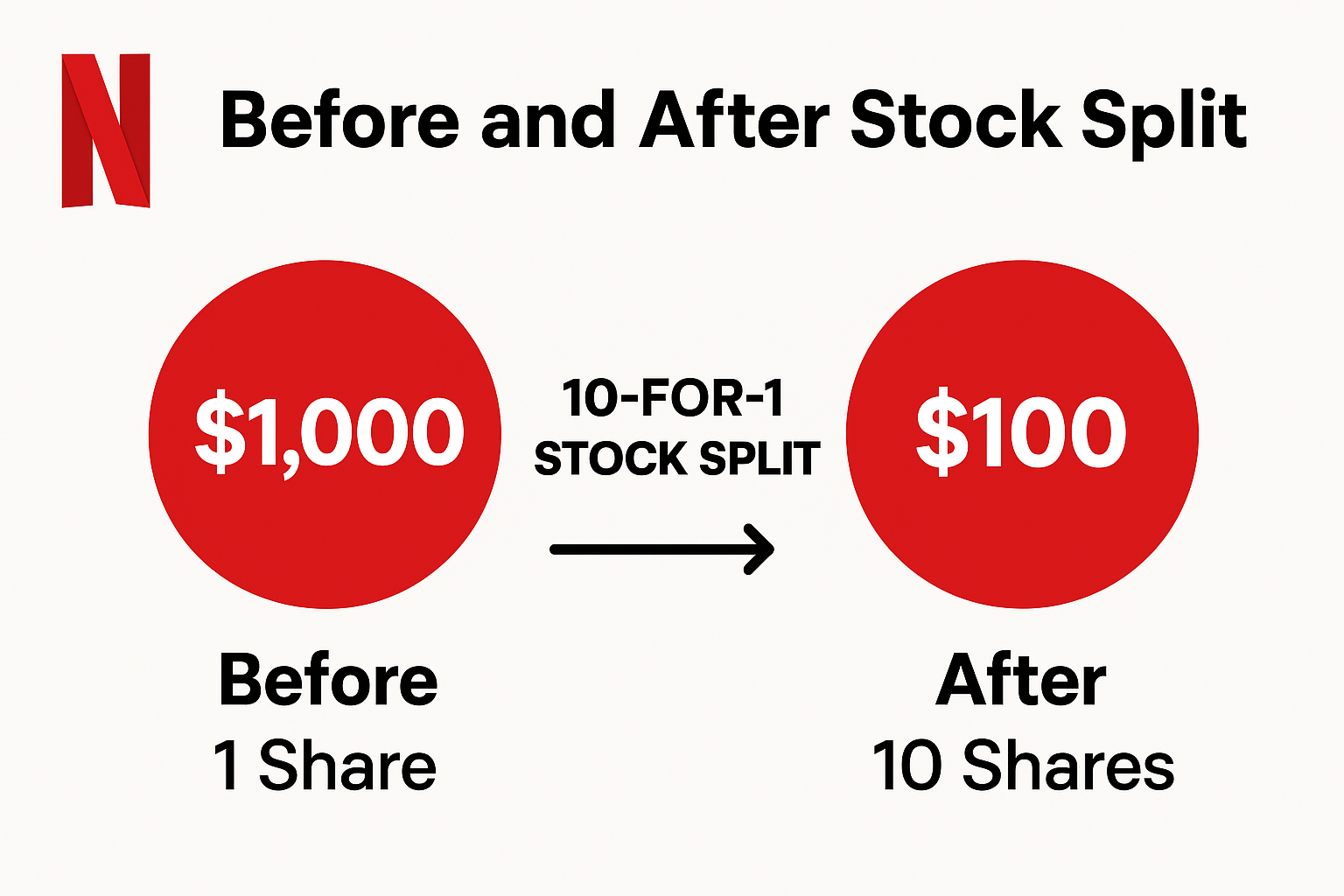

A stock split doesn’t alter the overall value of your investment — it merely divides your shares into smaller units.

For instance:

If you owned 1 share of Netflix valued at $1,000, after the 10-for-1 split, you would own 10 shares, each worth about $100.

The total value remains unchanged, but the share price becomes more manageable.

Such splits often draw in new investors who might have found it difficult to purchase high-priced stocks before. It also enhances liquidity, meaning shares can be bought and sold more easily.

🗓️ Important Dates to Note

Event Date

Record Date November 10, 2025

Split Effective Date November 14, 2025

Trading on Split-Adjusted Basis November 17, 2025

So, if you’re a Netflix shareholder before November 10, you’ll automatically receive the extra shares once the split is implemented.

Why Did Netflix Decide to Split Its Stock Now?

Netflix has announced that the main reason for the stock split is to make shares more accessible for employees involved in the company’s stock option program.

However, there are additional factors at play:

- Attracting New Investors:

With shares priced in the thousands, many small investors feel excluded. By lowering the cost per share, Netflix is inviting a broader range of investors to participate. - Boosting Liquidity:

Typically, lower share prices lead to increased trading activity. More transactions can enhance the company’s stock stability. - Positive Market Sentiment:

Stock splits often generate excitement and renewed interest. While splits don’t alter a company’s fundamentals, they can spark short-term bullish trends.

Market Reaction: Investors Are Excited

Wall Street reacted positively to the news. Netflix shares surged by over 2–3% in after-hours trading, and analysts believe this move could encourage more long-term retail investment.

Before the split, Netflix shares were around $1,080, so post-split prices could begin at approximately $108 per share.

While this lower price may not affect the company’s market cap, it certainly makes the stock more appealing to everyday investors.

What This Means for Indian and Global Investors

For international investors, including those in India who purchase US stocks through platforms like Groww, INDmoney, or Vested, this presents a fantastic opportunity.

A lower share price means:

Smaller investments can now acquire more shares.

Dollar-cost averaging (gradually buying in) becomes more feasible.

It’s easier to establish long-term exposure to one of the leading streaming companies in the world.

Nonetheless, investors should keep in mind that a stock split doesn’t alter the fundamentals. Netflix must continue to deliver strong earnings, expand globally, and grow its ad-supported streaming business to sustain its momentum.

⚖️ The Bigger Picture: Netflix’s Growth Story

In recent years, Netflix has transformed into much more than just a streaming platform.

It’s making significant investments in ad-supported plans,

Developing a robust gaming division,

And branching out into live events and sports content.

These strategies reflect Netflix’s ambition to lead the global entertainment landscape. The stock split simply facilitates broader participation in that journey.

As one analyst noted:

“This split doesn’t change Netflix’s business — but it changes how many people can be part of its success story.”

🧠 What Should You Do as an Investor?

If you already hold Netflix shares, there’s no need for any action — the split will occur automatically.

For those considering a purchase, this could be a great opportunity. The reduced price per share might make Netflix stock a more appealing option.

However, it’s essential to keep an eye on the fundamentals — assess Netflix’s revenue growth, subscriber figures, and future strategies before making any investment.

✍️ Final Thoughts

Netflix’s 10-for-1 stock split sends a clear signal: the company aims to welcome more participants — employees, investors, and fans alike.

While it doesn’t directly enhance the company’s value, it paves the way for millions of smaller investors who appreciate Netflix’s success story.

With its ongoing commitment to original content, global growth, and advertising, Netflix continues to be a leading innovator in the entertainment industry. The stock split simply makes it easier for everyone to have a stake in that innovation.

🔗 External Links

- Reuters – Netflix Announces Ten-for-One Forward Stock Split

(Official announcement details including record and trading dates.) - Yahoo Finance – Netflix’s 10-for-1 Stock Split to Boost Accessibility

(Coverage on employee stock program and market impact.) - Business Insider – Why Netflix Split Its Stock in 2025

(Analysis of the market psychology behind stock splits.) - Bloomberg – Netflix Aims to Make Stock Ownership Easier

(Insight into Netflix’s employee-centric reason for the split.) - Kiplinger – What Netflix’s 10-for-1 Split Means for Investors

(Investor-focused explanation of how the split affects share value and ownership.)

1 thought on “Netflix stock split: Netflix Announces 10-for-1 Stock Split: What It Means for Investors”