Understanding the GameStop (GME) Stock Split — What It Means for Investors in 2025

GME Stock Split:

— 🔹 Introduction GameStop Corp. (NYSE: GME), one of the most discussed “meme stocks” in recent history, is back in the news — this time due to its stock split.

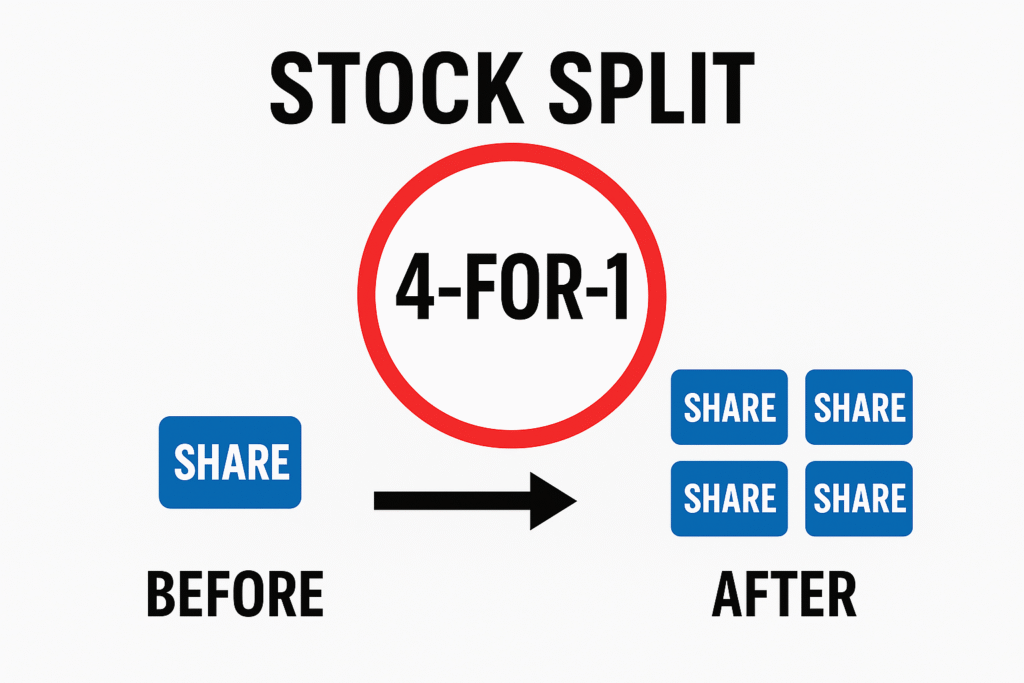

The company has recently executed a 4-for-1 stock split, capturing the interest of both long-term investors and short-term traders worldwide. But what is a stock split, and why is it significant?

Let’s simplify it and explore what this decision means for GameStop’s future. —

What is a Stock Split?

A stock split occurs when a company divides its existing shares into multiple new shares. The aim is to make each share more affordable while keeping the company’s overall market value unchanged.

In the case of GameStop, it was a 4-for-1 stock split. This means that for every one share an investor owned, they received three additional shares.

So, if someone had 10 shares before the split, they now have 40 shares — but the total value of those shares remains the same. —

Why Did Game stop Split It’s Stock?

There are several reasons behind this decision:

1. To Make Shares More Affordable Before the split, GME’s stock price was quite high. By splitting the shares, the company made it easier for smaller investors to enter the market — especially those who were reluctant to spend hundreds of dollars on a single share.

2. To Increase Market Liquidity Having more shares available means more buying and selling activity. This can enhance liquidity and attract more traders to the stock.

3. To Foster Positive Investor Sentiment Let’s face it — GameStop’s name still carries a lot of weight in the market.

What Does It Mean for Existing Investors?

If you owned GME shares before the split, here’s what you need to know: You automatically received three new shares for every one share you had. The total value of your holdings remained unchanged — no loss or gain at that moment.

Your cost per share was divided by four. For instance, if you had 10 shares priced at $160 each (totaling $1,600), after the split you’d have 40 shares priced around $40 each. So, while it may seem like you have “more shares,” the overall value hasn’t changed — only the price per share has. —

How Did The Market React?

When GameStop announced its stock split, the news initially created a buzz. The stock experienced short-term volatility as traders jumped in, hoping for another meme-style rally.

However, the fundamentals remained unchanged — the company’s financials, revenue, and challenges in the gaming retail sector stayed the same. Since then, GME has continued to show a blend of investor enthusiasm and caution.

While dedicated retail investors still hold out hope for a turnaround, analysts remain doubtful about GameStop’s long-term growth until it demonstrates solid progress in digital transformation.

Does a Stock Split Mean Game stop will Rise Again?

That’s the big question! But here’s the reality: A stock split doesn’t increase a company’s value. It merely divides the same pie into more slices.

For GME to rise again, it needs to concentrate on: Strengthening its digital gaming business Expanding its online marketplace Managing costs and profitability in a competitive gaming industry If the company can successfully transition from physical retail to a more robust e-commerce model, GME could regain momentum beyond just meme hype. —

🔹 Risks Investors Should Know Before diving into GME after hearing about the split, keep these risks in mind: Volatility: GME remains a highly volatile stock, with price fluctuations driven by online sentiment. No Change in Fundamentals: The split doesn’t enhance earnings, so be cautious.

Final Thoughts:-

The GameStop 4-for-1 stock split serves as a reminder that while numbers can fluctuate, true value is rooted in performance. This move has made GME more accessible and reignited public interest in the stock.

However, the real question is whether it will lead to sustainable success, which hinges on how effectively the company implements its digital transformation strategies.

For now, investors should remain grounded, conduct thorough research, and prioritize long-term fundamentals over short-term hype

🔗 External Links (For Reference)

If you interested about know asst stock, so you can read this article 👇

https://bartatime.com/asst-stock-soars-after-big-merger-move/

1 thought on “Understanding the GameStop GME Stock Split — What It Means for Investors in 2025”